- Introduction

- 1. Can foreigners Buy Condo in Philippines?

- 2. How is Land acquired for Condominium development?

- 3. What type of properties are available for foreign nationals to buy in the Philippines?

- 4. Do foreign buyers obtain a housing loan in the Philippines?

- 5. Review Can a Foreigner open a Bank Account in the Philippines?

- 6. What I need to do before buying a property (condo) in the Philippines?

- 7. Review requirements for buying a condo in Philippines (Buyers Requirement)

- 8. How much does it cause to buy a condo in the Philippines?

- 9. How to find and choose property in the Philippines?

- 10. What are the Property rights and ownership of property in the Philippines for a property purchased.

- 11. What are the real estate tax and miscellaneous cost payable for property purchase by Buyer and Seller in the Philippines?

- 12. What are the holding cost of a condo (including tax) in the Philippines?

- 13. Review Why are foreigners buying condo in the Philippines

- 14. Terms used in real estate in philippines (Glossary of Real Estate terms)

Introduction

This article is a ultimate guide to inquiries by foreigners from different countries on property in philippines for sale.

It is basically a a guide to both Filipinos and Foreigners: How to buy property in the Philippines as a foreigner / Filipino: Step by Step Guide

It answers to various questions about purchasing condo in the Philippines by international global buyers who ask, can foreigners buy condo in Philippines.

It discusses the latest and relevant Philippines real estate rules, statute and law on foreigners buying property.

You will learn the A to Z of what the property buyer’s need to know before and after buying a condominium in the Philppines.

And finally you will get tips on presently where in Philippines is the best place for foreigners to buy condos and villas property in Philippines for sale

The good news to the question:

Can Foreigners Buy Condo in Philippines?

Answer is a Big YES .

REPUBLIC ACT No. 4726, Section 5

Can Foreigners Buy Condo in Philippines definitely foreigners can buy a condo titled property in all areas of the Philippines.

The property to be purchased, its Land Title must have a title called, Condominium Certificate of Title.

Now let’s see the details of can foreigners buy condo in Philippines in depth.

There are 6 ways foreigners can own land & buy real estate in all areas of the Philippines.

Foreign nationals commonly own land or real estate in Philippines by having a Filipino spouse ( Filipino wife).

What foreign nationals must know is that being an international buyer, you can also buy and own a condominium without getting married to a Filipino or having a Philippines citizenship.

It is a legal real estate ownership to solely own a condo or villas in your name thus answering the question of Can Foreigners Buy Condo in Philippines.

Discussion on the 6 ways foreigners can own land and buy real estate in the Philippines, will need to be very elaborate.

However in this article I am going to discuss details of One of the ways. –

“can foreigners Buy condo in Philippines”

and discuss the following points, which are relevant

- Can foreigners buy condo in Philippines?

- How is Land acquired for Condominium development?

- What type of properties are available for foreign nationals to buy?

- Do foreign buyers obtain a housing loan in the Philippines?

- Review Can a Foreigner open a Bank Account in the Philippines?

- What You need to do before buying a property (condo) in the Philippines?

- Review requirements for buying a condo in philippines (Buyer’s Requirement).

- How much does it cause to buy a condo in the Philippines?

- How to find and choose property in the Philippines?

- What are the Property rights and ownership of property in the Philippines after purchased?

- What are the real estate tax and miscellaneous cost payable for property purchase by Buyer and Seller in the Philippines?

- What are the holding cost of a condo (including tax) in the Philippines?

- Review Why are foreigners buying condo in the Philippines?

- Terms used in real estate in philippines (Glossary of important terms)

1. Can foreigners own a condo in the philippines?

Law on sale of real property in Philippines which allows foreign nationals to buy condo in all areas of the philippines city is:

The Philippine Condominium Act allows foreigners to own condo units, as long as 60% of the building is owned by Filipinos.

That means in a condo development only 40% of the unit can be owned by foreigners.

Another important fact is, the residential building or the apartment must have a Condominium Certificate of Title.

REPUBLIC ACT No. 4726, Section 5 states that “

“at least sixty percent of the capital stock of which belong to Filipino citizens”

REPUBLIC ACT No. 4726, Section 5,

It is an Act to Define Condominium, Establish Requirements for its Creation and Govern Its Incidents

called “The Condominium Act.” for short.

So now you know which statute allows foreigners buy condo in Philippines, “The Condominium Act.”

The rule of thumb is, in any condominium complex , the percentage composition of ownership by foreigners must not exceed 40%.

For new preselling condos in Philippines, this is being monitored and ensured by the property developer.

2. How is Land acquired for Condominium development?

All real estate land for a condo project is bought by the property developers from private landowners or from the local government for developing into condominium complexes in any area of the Philippines.

These land titles are bought as clean freehold titles.

This freehold title will be transferred to the condo investors / owners by the property developers upon receipt of full payment via cash or bank financing.

A point to take note here, the transfer of condo title is a very tedious and detailed process in the Philippines which involves many governmental departments.

Therefore the actual title deeds may take many months or even years to be transferred to the buyers.

For example it took the real estate developer 5 years to give me my Title Deeds.

Global buyers must know that this is not an alarming situation in the Philippines but this is actually an accepted norm by the Filipino people in view of the different departments involved in the process.

There are Two types of Status when purchasing a Condo:

| 1. Preselling Condo |

| Newly launch condo or still ongoing construction condo |

| 2. Ready for Occupancy (RFO) |

| Condo which is completed and can move in based on the payment terms. |

There are exceptions in a situation whereby a foreign property developer is allowed to develop a condominium in the Philippines but the title deed of the condo will be only 99 years (Leasehold) NOT Freehold title.

3. What type of properties are available for foreign nationals to buy in the Philippines?

Foreigners can buy Condominium Titled property in Philippines for sale

What is the condo-titled property in the Philippines?

The Land Registration Authority issues a documented proof of a person’s ownership over a condominium unit called Condominium Certificate of Title (The property developer gets it done for you)

Types of Condominium Certificate of Title Projects (CCT)

- TYPE 1

- Condominium Complexes

- Consisting of tall and short buildings with amenities, pools and multipurpose halls among others.

- TYPE 2

- Villa

- Villas or houses which come with a CCT. Sometimes these houses or villas are built within the condominium projects that render them to have a CCT.

4. Do foreign buyers obtain a housing loan in the Philippines?

In every country when the investment opportunities in the real estate market gets hot, the mortgage financing policies are also being changed by the central banks dynamically.

Here I will discuss the availability of residential mortgage loans to foreigners buy property in Philippines

For the purpose of this article, this information is only relevant to foreigners buy condo in the Philippines, excluding the following:

- foreigners who are married to a Filipino

- expats who hold any one of a specific series of visas, including Quota or Preference Immigrant Visas

- Special Resident Retiree Visas

- Permanent residence status such as Alien Certificate of Registration (ACR)

- Working visas

As of April 2022, foreign nationals who do not fall into the above category are NOT ELIGIBLE for any housing mortgage loans.

What are the other alternatives

- Use their cash to buy

- Obtain a personal loan in their own country

5. Review Can a Foreigner open a Bank Account in the Philippines?

If you have been staying in Philippine for less than 180 days, you are classified as a non-resident alien.

Such foreigners can open a bank account and only limited to a foreign currency deposit account, such as a dollar savings account.

You cannot open a peso savings account.

As the Philippines banks differ in their policies regarding opening accounts for foreigners, please get assistance from your real estate professional to proceed on banking matters as the real estate agent usually liases with the respective bank managers very closely.

6. What I need to do before buying a property (condo) in the Philippines?

1. Contact a broker or real estate agent

All real estate professionals must be accredited by the PRC and DHSUD

2. Discuss the various condos available based on your budget and requirements such as location.

3. Ask for the various e-brochures/hard copy and information of the shortlisted condos and study it carefully and clear all doubts with the real estate professional.

4. Do NOT buy a pre selling condominium property without the License to Sell Certificate (LTS), a property without LTS can only accept a Letter of Intent (LOI)

5. Visit condo showroom / actual unit (if applicable)

6. Prepare the Reservation Fee (P5000 to P100K) depending on the type, price and terms of the property

7. Pay the Reservation Fee accordingly, fill up the forms and submit the relevant documents

8. Sign the relevant documents such as the contact to Sell (CTS)

9. Receive the relevant signed documents, such as Contact to Sell (CTS)

10. The CTS will be your sole documentary proof of your purchase until you receive your Deed of Absolute Sale (DAS) or your Title Deed.

11. Ensure you keep up with the equity payments until the condo becomes ready for Occupation

12. When the unit is turn over to you the buyer, make the final payments

13. Before accepting the unit, check the unit thoroughly for defects with the real estate developer representative and your realtor, this is called a punch list.

14. Now you are the proud Owner of your condo.

7. Review requirements for buying a condo in Philippines (Buyers Requirement)

Fill up the Buyer’s Information Sheet (BIS) – provided by the real estate developer

- Main points to note in BIS

- If a buyer is married, the buyer’s spouse details must be provided even if the spouse is not contributing money to the purchase.

- Tax Identification Number (TIN)

- All buyers must apply for the TIN from the Bureau of Inland Revenue (BIR). The real estate agent or developer will be able to assist in this application.

- If a buyer applies themselves it can be done in a day, however if the real estate agent or the developer is assisting then it may take 2 weeks with a service fee of approximately P400.

- 2 valid Official Identifications

- Annual Income Return Statement ( in some cases where there are big discounts for the property purchased)

- Post dated cheques for monthly equity payment (only local cheques)

- Copy of Birth certificate and Marriage certificate (if married)

- Other certificates such as Annulment certificate, Death certificate where applicable.

8. How much does it cause to buy a condo in the Philippines?

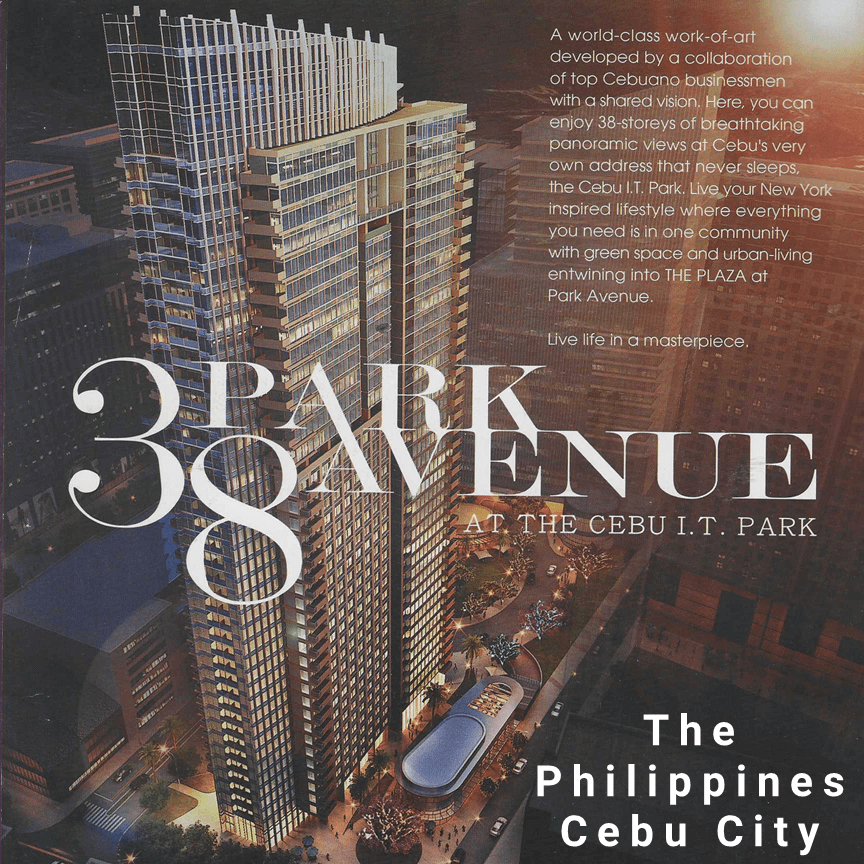

Here is a sample computation plan of a pre selling condominium in Cebu City at a prime real estate location.

The average price of a condo in cebu city is P2.8M – Studio 22sqm (as of April 2022)

I am using a 2 bedroom as an example so that you will know what could be the medium upper range of the outlay of your initial and total investment for a bigger unit.

Of course there are units bigger than 2 bedroom, such as the Penthouse.

However for smaller unit you an scale the amount proportionally or click the button below for more details.

Initial Outlay (Option2)

Step 1: (A) Reservation Fee

Step 2: (B) Lump Sum payment or pay monthly for 40 months

Final Outlay

Step 3: (C) Final Payment – Turn Over of Unit

9. How to find and choose property in the Philippines?

In my discussion I will be using Cebu City as an example rather than capital Manila.

Why Cebu city? Cebu is not only the queen city of the Philippines, let’s see at more details as compared to Manila City.

These following factors makes Cebu a more attractive property investment location.

- The overall miscellaneous cost for buying property in Cebu is lower than Manila.

- Annual Real Property Tax (RPT) is lower in Cebu as compared to Manila.

- Therefore Property Prices are more affordable compared to the same type of property in Manila

- Gateway for tourism activities

- among the cities, an increasing influx of tourist visiting and staying in Cebu City due to its strategic location and proximity of great beaches

- As Cebu is home to world class Business Processing Offices (BPO), there is a big expat community who are seeking to rent apartments

- High Rental income

- Cebu is not as crowded as Manila (NCR).

- Cebuano are friendly and safe place.

- Upcomng new infrastructure projects will cause real estate price appreciation

- Cebu is designed by avoiding the pitfalls of Manila, eg cebu has more land area to have a more spaciously planned city

- More real estate investment opportunities – Mactan Island, Bohol and more…

Finding and choosing a property in cebu

- Communicate with a PRC and DSHUD Accredited Real Estate Professional on:

- Inform that you will need buy a property with a Condominium Certificate of Title

- Discuss budget to buy a condominium

- Inform that you will need buy a property with a Condominium Certificate of Title

- Purpose/ Goal of Investment – passive income, retirement etc

- Discuss the most appropriate location in Cebu to buy a property based on your budget, recommended loactios are:

- Cebu City

- Mandaue City

- Lapu-Lapu City in Mactan Island

- Type of Condo to be purchase

- Condo in city

- Beachfront Condo

- Condo at mountain

- Type of Neighborhood, such as expats community at the vicinity of the property and perform a site visit if possible

- Requirements of real estate developers or sellers for property purchase

- Ongoing real estate promotions or discounts

- Any hidden cost- extra real estate documentation cost if any

- Timeline to commit your property investment

10. What are the Property rights and ownership of property in the Philippines for a property purchased.

A foreigner can own a property forever if that property has a Condominium Certificate of Title and at the sametime has a Freehold Title.

For a property with a Condominium Certificate of Title but with a Leasehold Title, then that property can only be owned for that specific period of time.

For example – 99 years ownership for 99 years leasehold title condominium.Even though most of the properties are Freehold Title in Philippines but it is always very important to check the title status of the property to be purchase.

11. What are the real estate tax and miscellaneous cost payable for property purchase by Buyer and Seller in the Philippines?

What are the extra costs of home buying in the Philippines?

The following are the schedule of Tax document payment by buyer and seller.

| FEES | % PAYABLE | PAYING PARTY |

| Notary Fee | 1% – 2% | Buyer |

| Local Transfer Tax | 0.50% – 0.75% | Buyer |

| Registration Fee | 1% | Buyer |

| Documentary Stamp Tax | 1.5% | Seller |

| Capital Gains Tax | 6.00% | Seller |

| VAT (Value Added Tax) Below P3,199,200.00 | 0% | Buyer |

| VAT (Value Added Tax) Exceeding P3,199,200.00 | 12% | Buyer |

| Real Estate Agent´s Fee | 3.00% – 5.00% | Seller |

| Total Costs paid by Buyer: 1.50% to 3.75% (based on with 0% VAT) | ||

| Total Costs paid by Seller: 3.00% to 12.50% |

12. What are the holding cost of a condo (including tax) in the Philippines?

When you become the owner of a condo in the Philippines, the following are the holding cost:

- 12.1 The Annual property tax is called ‘Annual Real Property Tax (RPT)‘

- Annual Real Property Tax (RPT)

- Property owners are required by law to pay RPT annually. The local government determines a fair value of your property for payment of real property tax.

- The law requiring payment is:

- Section 233 of the Local Government Code of 1991 or Republic Act no. 7160, determines the prescribed assessment value to be paid on the following percentage of the fair market value of your property.

- Annual Property tax for Province in Philippines – 1% (eg: Cebu)

- Annual Property tax for City or Municipality within Metro Manila – 2%

- 12.2 When to pay Real property tax?

- Becomes payable on the 1st day of the year

- Payable by whoever owns the property based on the name on the Title Deed on that every day of the year (1st day of January)

- Schedule of payment

- 1. Full payment for the entire year

- 2. Quarterly Installments (On or before the date)

- a.) 1st Installment – On or before the date March 31

- b.) 2nd Installment – On or before the date June 30

- c.) 3rd Installment – September 30

- d.) 4th Installment – December 31

- Discounts for prompt payment

- Upto 20% – if pay in full in month of January

- 12.3 What Happens if I Fail to Pay My Real Property Tax in Philippines?

According to Section 255 of the Local Government Code of the Philippines,

failing to pay Real Property Tax (RPT) shall:

- pay interest of 2% per month

- “shall subject the taxpayer to the payment of interest at the rate of two percent (2%) per month on the unpaid amount or a fraction thereof, until the delinquent tax shall have been fully paid: Provided, however, that in no case shall the total interest on the unpaid tax or portion thereof exceed thirty-six (36) months.”

- If after the said 36 months you still fail to pay your annual RPT, and the maximum interest of 72 percent had accrued on top of it,

- then per Section 258:

- “real property subject to such tax may be levied upon through the issuance of a warrant on or before, or simultaneously with, the institution of the civil action for the collection of the delinquent tax.”

- The local government unit (LGU) can take action to sell your property all of it, or a usable piece of it, to fulfill the unpaid dues as well as cover the costs of the action.

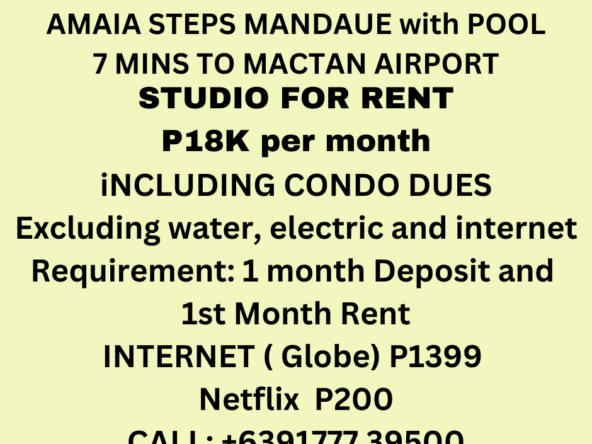

Condominium Dues (Association dues)

Condominium Dues dues are monthly dues payable by the condo owners to contribute to the cost of the general upkeep of the whole condo building.

The law pertaining to homeowners’ association is by stipulated by the Department of Human Settlements and Urban Development (DHSUD)

What is an average condo dues?

Usually it is calculated by per sqm

For example the average per sqm in cebu is 80 pesos

Therefore for a 25sqm condo unit:

80 x 25 = P2000 (US$36) per month of condo dues

Home Fire Insurance

Even though Home Fire Insurance is not mandatory for properties which do not have a housing mortgage loan, it is important to protect one’s property from damage caused by fire and other unexpected events.

What is the Average Cost of Home Fire Insurance in Philippines?

The average cost of a Fire Insurance for a 25sqm (270sqft) property is Php 3500 (US$63)

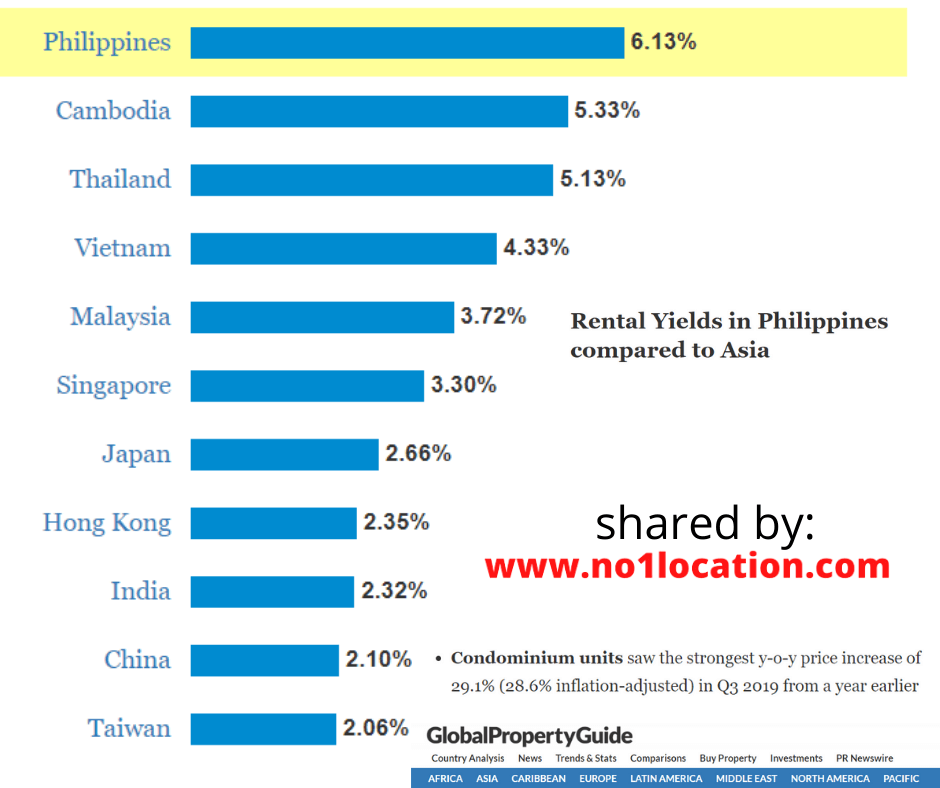

13. Review Why are foreigners buying condo in the Philippines

- Codominium complexes are inexpensive compared to their home country properties

- Freehold unlike in some countries its 99 years leasehold property

- Great potential for price appreciation

- Good legal framework to protect the various property players

- No restrictive laws that discriminate between the local and the foreign owners unlike some other countries

- Retirement real estate investment

- Safe secure environment with friendly people in Philippines

- Great potential for rental income due to the booming tourism industry and multinational companies setting up BPO and ICT businesses

14. Terms used in real estate in philippines (Glossary of Real Estate terms)

Notary Fee

The law requires some documents to be notarized.

One of them in real estate purchase is The Deed of Absolute Sale which needs to be notarized:-

- about 1-2% of the property purchase price. Such fees are paid by buyer

Local Transfer Tax

This tax occurs when transferring ownership of the property from the owner to the buyer.

The amount depends on the location of the said property whether it is in the municipality in provinces or within metro manila area.

The local transfer tax can cost:

- provincial properties – 0.50% of the property value

- within Metro Manila – 0.75% of the property value

Such fees are paid by buyer

Registration Fee for real estate In Philippines

The act of making a ownership of a property legal, one must register the transfer of ownership at the local Registry of Deeds where the property is located.

Such a fee is about 1% of the property purchase price paid by the buyer.

Documentary Stamp Tax (DST) in Philippines

This Documentary Stamp Tax tax is paid on the selling price or fair market value of the property, whichever is higher.

The documents relevant for this are, Deed of Sale, Conveyances, Donations of Real Property (except grants, patents or original certificate of adjudication issued by the government)

On a scale it is usually about 1.5% (% of Unit) a seller has to pay for the documentation of the sale.

(Tax Due Per Unit) First 1,000 – P15.00

(Tax Due Per Unit) For each additional P1,000 or fractional part thereof in excess

of P1,000 – P15.00

Capital Gains Tax (CGT) in Philippines

Residential properties are categorized as capital assets

Therefore the seller pays the capital gains tax levied at 6% of the gross selling price or fair market value of the property, whichever is higher.

VAT (Value Added Tax) in Philippines

Value Added Tax (VAT) is the tax levied on the sale, barter, exchange or lease of goods, properties or services based on the gross selling price of properties sold.

This is currently at 12% rate.

VAT is zero-rated or exempted for Sale of House and Lot and other residential dwellings for selling price not exceeding P3,199,200.00

The Burea of Inland Revenue (BIR) of the Philippines amended certain provisions of RR No. 4-2021, which implemented the VAT and Percentage Tax provisions under RA No. 11534 (CREATE Act) Revenue Regulations No. 8-2021, June 11, 2021)

Reservation Fee

The first commitment fee paid by the buyer to the property developer to secure the buyer’s intention to buy the property.

In the event that the buyer decided not proceed with the purchase within a stipulated time period, the reservation fee is forfeited and no further damages are claimed by the seller/developer.

The Reservation Fee usually ranges from P5000 to P250,000 depending on the selling price of the property.

The higher the selling price of the property , the higher is the requirement for the reservation fee by the seller or property developer.

Real Estate Agent’s Fee

The seller pays the real estate agent’s fee about 3-5% for securing the buyer for the seller or the real estate developer.

The agent also walks through the entire process for the buyer to ensure that the purchase process goes on without any hiccup especially with regards to the buyer’s documents without any additional cost.

Turn over of property

When a property is completed by the property developer, it will be handed over to the purchaser

Punch List

The process of checking the property for defects by the buyer before fully taking over the house.

Move-in Fees

Upon turn over your property must be connected to utilities such as water and electricity and also the first month’s maintenance dues by the management corporation of the condo.

The buyer pays these fees to make the unit liveable.

Pls check with the real agent for such fees before paying the reservation fee.

Some property developers may have a fixed amount for move-in fees.

Professional Regulation Commission (PRC)

The Professional Regulation Commission, otherwise known as the PRC, is a three-man commission attached to Department of Labor and Employment.

Its mandate is to regulate and supervise the practice of the professionals who constitute the highly skilled manpower of the country

DEPARTMENT OF HUMAN SETTLEMENTS AND URBAN (DHSUD)

HOUSING and LAND USE REGULATORY BOARD (HLURB)

The Department of Human Settlements and Urban Development (DHSUD) is the central housing authority in the Philippines.

It has absorbed the duties and functions of the Housing and Urban Development Coordinating Council (HUDCC) and the Housing and Land Use Regulatory Board (HLURB). It is currently headed by Secretary Eduardo D. Del Rosario.

Preselling Condo

Condos or Villas can be sold ONLY with a License to Sell (LTS) at the following stages:

- 1. Pre planning stage

- 2. At New launching

- 3. During Construction

This article is a comprenhsive ultimate step by step guide to

Can Foreigners Buy Condo in Philippines

If you are a potential buyers of real estate in philippines, read through this article and ensure that all the points discuss here are followed, than definitely you will have a successful real estate investment in the Philippines.

Please leave comments and inquiries here, I will try my best to answer your quiries timely.

Thanks for reading this article and please share this article if you think someone will benefit from this article.